h24.site

News

Best Low Overhead Businesses

For the best profitable business ideas with low upfront investments, consider starting a dropshipping business, a handyman business, or a newsletter business. Hudson Valley Swim is a highly profitable business with a low-cost and low-overhead structure. Our lesson program provides premium instruction from senior. business ideas with low startup costs · 1. Accounting and bookkeeping · 2. Online affiliate sales · 3. Airbnb host · 4. Antique refurbishing · 5. Mobile app. Angel investors, venture capitalists, and conventional bank loans are among the funding sources available to small businesses but not every company has the. Personal or virtual assistant Entrepreneurs who are growing their businesses must focus on high-return tasks. They need professionals with good organizational. If you have a green thumb and enjoy working outdoors, starting a gardening or landscaping business can be a low-cost and rewarding venture. As a landscaping. Looking for businesses to start with $10K or less? From pet sitting and dropshipping to furniture flipping and pressure washing, discover the top low-cost. Freelance and service-based businesses offer a versatile and accessible way to leverage your skills and expertise from home. The best online business ideas. 20 cheap businesses you can start with $ or less · 1. Online seller. graphic of a person at a laptop next to online shopping tabs · 2. Virtual educator/trainer. For the best profitable business ideas with low upfront investments, consider starting a dropshipping business, a handyman business, or a newsletter business. Hudson Valley Swim is a highly profitable business with a low-cost and low-overhead structure. Our lesson program provides premium instruction from senior. business ideas with low startup costs · 1. Accounting and bookkeeping · 2. Online affiliate sales · 3. Airbnb host · 4. Antique refurbishing · 5. Mobile app. Angel investors, venture capitalists, and conventional bank loans are among the funding sources available to small businesses but not every company has the. Personal or virtual assistant Entrepreneurs who are growing their businesses must focus on high-return tasks. They need professionals with good organizational. If you have a green thumb and enjoy working outdoors, starting a gardening or landscaping business can be a low-cost and rewarding venture. As a landscaping. Looking for businesses to start with $10K or less? From pet sitting and dropshipping to furniture flipping and pressure washing, discover the top low-cost. Freelance and service-based businesses offer a versatile and accessible way to leverage your skills and expertise from home. The best online business ideas. 20 cheap businesses you can start with $ or less · 1. Online seller. graphic of a person at a laptop next to online shopping tabs · 2. Virtual educator/trainer.

26 Best Business Ideas With Low Investment And High Profit · Raj Kumar · Start a Dropshipping Business · Social Media Consultant · Create. A faucet, lightbulb, cash, check and other uses for working capital. Like seasonal financing, export loans, revolving credit, and refinanced business debt. 20 Businesses You Can Start with $1, · That being said, there are a number of business ideas with low investment required that you can start for as little as. From clearing gardens and lofts to providing handyman services, helping people with tasks that they don't fancy doing is a good way to get started in a business. We found 34 low cost business ideas with high profit potential that will help you create an impact and income you can be proud of. 1. Accounting and bookkeeping. Use your training and experience as an accountant or bookkeeper to offer your services to individuals or businesses. · 2. Online. Any freelance business comes with low overhead. Whether through freelance writing, graphic design, web development or software coding, your skills can get you. Image from Here [1] Some of the best low overhead businesses include: 1. Consultancy 2. Coaching 3. Cleaning services 4. Pool cleaning 5. The event planning industry experienced a drawback during the pandemic. However, as places open, it will come back and make a good home business idea. People do. You can start small: sell beauty products, shoes, clothes or anything you're interested in. How do you know if you're a good fit for a career in sales? If you'. Car detailing stands out as one of the best small business ideas for those willing to put in some hard work in the early stages. While the monetary investment. A business in a high-growth industry with low startup costs, less competition and a good long-term outlook is most likely to be profitable. Examples are. Most Profitable Small Business Ideas () · 1. Website and app development. It should be no surprise that tech is one of the fastest-growing industries. · 2. From laundromats to self-storage facilities, investing in these businesses could produce significant side income with little day-to-day oversight. Legal. Similarly to accounting, legal services will always be required and valued and therefore very profitable if you provide a good service. Storage. 18 of the best business ideas to start with little money · Dropshipping · Print on demand · Selling on Amazon · Move your brick and mortar store online · Video. Small Business Tax Credit Programs · Emergency Capital Investment Program · Paycheck Protection Program · Bureaus · Inspector General Sites · U.S. Government Shared. business growth strategy for small business owners. But, there are key strategies you can use to give your business the best chance at growing. 10 Ways to. Overhead — expenses like utilities, technology, and rent — is one of the largest costs that most startups and small businesses have to contend with. If you can. 5. Cleaning A cleaning business is another good business model with low overhead costs. Plus, there are no educational requirements for providing cleaning.

Patreon Banner Maker

Try the "Minimalist Patreon banner template for artists" template. This template is a great starting point for your next image.. Try it out for Business. Fiverr freelancer will provide Social Media Design services and design a onlyfans, fansly or patreon banner within 2 days. Minimalist Patreon banner template for artists. This template is a great starting point for your next image. Try it out for Business themed designs. View Build. Patreon banner. Create your own build with the Darktide Build Editor. In Warhammer 40, Darktide you can create your own character. Most of the. Easily create an amazing design for your Patreon page cover using Placeit's design templates! Try out this series of designs featuring a modern style. Check out our patreon selection for the very best in unique or custom, handmade pieces from our templates shops. linkedin banner creator LinkedIn Banner Maker Create Free Online Headers Pixelied Album artwork for mxr patreon kemono mxr patreon kemono Aug · Album. Recent posts by Character Design References. English (United States) $ USD. Report this creator. •. © Patreon. Create on Patreon. Character Design. Post about your membership on social media; Mention it in your content; Add a banner or other splashy announcement to your website; Create a permanent home for. Try the "Minimalist Patreon banner template for artists" template. This template is a great starting point for your next image.. Try it out for Business. Fiverr freelancer will provide Social Media Design services and design a onlyfans, fansly or patreon banner within 2 days. Minimalist Patreon banner template for artists. This template is a great starting point for your next image. Try it out for Business themed designs. View Build. Patreon banner. Create your own build with the Darktide Build Editor. In Warhammer 40, Darktide you can create your own character. Most of the. Easily create an amazing design for your Patreon page cover using Placeit's design templates! Try out this series of designs featuring a modern style. Check out our patreon selection for the very best in unique or custom, handmade pieces from our templates shops. linkedin banner creator LinkedIn Banner Maker Create Free Online Headers Pixelied Album artwork for mxr patreon kemono mxr patreon kemono Aug · Album. Recent posts by Character Design References. English (United States) $ USD. Report this creator. •. © Patreon. Create on Patreon. Character Design. Post about your membership on social media; Mention it in your content; Add a banner or other splashy announcement to your website; Create a permanent home for.

Use Kapwing's YouTube banner maker to make your own YouTube banner image and Patreon. With over hundreds of templates and a huge library of videos. Fiverr freelancer will provide Social Media Design services and design onlyfans banner, twitter, patreon for girls within 2 days. Profile banner for VektroidLive Donations do not give you a free pass to push boundaries or misbehave, so please be chill! Panel Content. + [h24.site banner · size · template. More by this creator. [recreation] problem from solutions. icons. Quality patreon banner maker with free worldwide shipping on AliExpress. Create eye-catching Patreon banners online with the help of our professionally designed free Patreon banner templates that are easy to use and customize. Google Play Developer Banner Generator Sponsor this project. @DeveloppeurPascal DeveloppeurPascal Patrick Prémartin · h24.site · patreon. 2-Minute Tabletop Maps Volume 10 Banner - Guilded. Maps & Assets Volume 10 Download thousands of tokens and support the Token Editor team! I have a commercial licence (the Shopkeeper tier) on my Patreon. Get over free models available on Thingiverse, Printables and Makerworld: Thingiverse. Subscribe to our 3D printable miniatures Patreon and collect unique, high quality fantasy miniatures, monsters and terrain for RPGs or wargaming. Log in or sign up. Continue with Apple. Continue with Facebook. or. Continue. Need help signing in? By signing up, you are creating a Patreon account and. Patron members should be able to customize profile banners the same way they can customize posters. Letterboxd. patreon h24.site About; Partners · Patreon · Education Programs · Write For Us At the Trouble Maker level for $7 per month, it includes everything in. Integrate Patreon and Abyssale in a few minutes. Quickly connect Patreon and Abyssale with over apps on Zapier, the world's largest automation. Patreon banner. Prev Main Gallery Download Next. Patreon banner. By RagnareK, posted 2 years ago Artist, Fursuit Maker, LARPer. At last I had finish made my. 22+ Best Patreon Banners (Using a Patreon Cover Image Creator). Tutorial • Beginner. Today, we'll share over 22 awesome Patreon banner templates from Placeit. Gridded and Ungridded Versions. Access to Patron only Discord Channel. Intiate Map-Maker. Banner, Inline, None. Armor. AC. Modifier. Type. Hit Points. Average. Modifier Monster Maker. About. Contact · Become a Patron. Giffyglyph's Monster Maker ©. Design Maker · Logo Maker Mockup Generator T-Shirt Designer Banner Maker Flyer Maker Business Card Maker Book Cover Maker Album Cover Maker · More · Game Assets. Banner Depot. A collection of banners for gaming platforms. Available Depots: backgrounds, banner, covers, icons. 3DO. 3DO. Amazon. Amazon Games. Amiga.

What Happens If You Dont File Taxes One Year

What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due. Individuals who plan on filing their taxes late may incur a late file penalty of percent of the tax required to be shown on the return for each month or. The penalty for not filing your return is typically 5% of the tax you owe for each month or partial month your return is late. Timber Yield Tax Program: • A one-hundred-dollar ($) penalty will apply if you do not file your tax return by its due date. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. First, you may face a failure-to-file penalty. This is equal to 5% of the taxes you haven't paid, charged monthly for up to 5 months. You can file for up to three years past the due date to get your refund. There's no penalty for filing late if they owe you money. Late Payment Penalty. If you file your return within 6 months after the due date but do not pay the tax due until after that time, your return will be. If the withholding is sufficient to cover your taxes (i.e. you were owed a refund), there are no penalties. However, if the return was from tax. What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due. Individuals who plan on filing their taxes late may incur a late file penalty of percent of the tax required to be shown on the return for each month or. The penalty for not filing your return is typically 5% of the tax you owe for each month or partial month your return is late. Timber Yield Tax Program: • A one-hundred-dollar ($) penalty will apply if you do not file your tax return by its due date. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. First, you may face a failure-to-file penalty. This is equal to 5% of the taxes you haven't paid, charged monthly for up to 5 months. You can file for up to three years past the due date to get your refund. There's no penalty for filing late if they owe you money. Late Payment Penalty. If you file your return within 6 months after the due date but do not pay the tax due until after that time, your return will be. If the withholding is sufficient to cover your taxes (i.e. you were owed a refund), there are no penalties. However, if the return was from tax.

What happens if I don't file my tax report? If you fail to file a required tax report, the Comptroller's office will send you an estimated billing with. The IRS is so serious about late filing that the penalty for doing so is much higher (5% of unpaid taxes for every month you delay up to a 25% cap) than the. In addition to interest charged on any tax due, you could face separate penalties for both filing and paying late. The late filing penalty is 5% of the tax due. For taxes assessed on or after January 1, , the late payment penalty is 5% of the tax not paid by the original due date of the return. Beginning July 1. If you don't file taxes for one year, you may incur penalties and interest on unpaid taxes. The IRS can take legal action, such as wage. Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA) when he or she realizes income generating $1 or. Late Filing - Two (2) percent of the total tax due for each 30 days or fraction thereof that a tax return or report is late. The maximum penalty is 20 percent. The current year tax return is due on Tax Day. You may face tax late filing and/or late tax payment penalties if you file after the deadline and owe taxes. You will owe a late-payment penalty for unpaid tax if you do not pay the tax you owe by the original due date of the return, even if you have an extension of. Even if you do not have the funds to pay your outstanding tax liability by the due date, you should still file your tax return, so you don't incur extra failure. The more likely outcome would be the IRS charges you with a failure to file and failure to pay, which carries a penalty of 5% based on the time from the. You generally have 3 years from the date the return was originally due to file and prove your eligibility for a refund. Even if you don't have a refund. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies. An account becomes delinquent when the due date for a tax return or other established liability has passed and the amount due remains unpaid. For failure to file a return on time, a penalty of 5 percent of the tax accrues if the delay in filing is not more than 30 days. An additional 5 percent penalty. What happens if you don't file taxes for your business? · Fines and interest · Loss of deductions and credits · General tax liens · Substitute for Return (SFR). At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. You can file a late return without an extension. If you do not owe taxes or you expect a refund, you may not owe a penalty. If you owe taxes, you may be charged. If you file your tax return but don't pay what you owe, you'll likely receive a letter from the IRS detailing how much you owe and asking you to pay. “One of. These penalties can get up to 25% of your unpaid tax liability, and interest accrues on your unpaid taxes until you pay them. When you don't file a tax return.

Which Credit Card Is Low Interest

Looking for a low interest credit card? American Express offers a variety of cards that can help you save on interest. Learn more and apply online. Card Details. View important rates and disclosures. QuicksilverOne Rewards product image · QuicksilverOne Rewards. Fair Credit credit line in as little as 6. Hear from our editors: The best low-interest credit cards of September · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard®. While getting a low APR is important, what's even more important is avoiding paying interest altogether if possible. You can do this by paying off your balance. Citi® Diamond Preferred® Card: Best feature: month 0% introductory rate on balance transfers. Wells Fargo Reflect® Card: Best feature: Lengthy low. Enjoy a 2% lower APR on Huntington's Voice credit card. Our low APR credit cards are a great option for new and existing Huntington customers. Best Low Interest Credit Cards of September · BankAmericard® Credit Card · Discover it® Balance Transfer · Upgrade Cash Rewards Visa® · Applied Bank. Below, CNBC Select reviews the best credit cards with low interest rates that can save you on interest charges while still earning rewards and enjoying other. » CREDIT CARDS WITH A LOW ONGOING INTEREST RATE · AFCU Platinum Visa® Rewards Credit Card · Air Force Federal Credit Union Visa Platinum Credit Card · Andrews. Looking for a low interest credit card? American Express offers a variety of cards that can help you save on interest. Learn more and apply online. Card Details. View important rates and disclosures. QuicksilverOne Rewards product image · QuicksilverOne Rewards. Fair Credit credit line in as little as 6. Hear from our editors: The best low-interest credit cards of September · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard®. While getting a low APR is important, what's even more important is avoiding paying interest altogether if possible. You can do this by paying off your balance. Citi® Diamond Preferred® Card: Best feature: month 0% introductory rate on balance transfers. Wells Fargo Reflect® Card: Best feature: Lengthy low. Enjoy a 2% lower APR on Huntington's Voice credit card. Our low APR credit cards are a great option for new and existing Huntington customers. Best Low Interest Credit Cards of September · BankAmericard® Credit Card · Discover it® Balance Transfer · Upgrade Cash Rewards Visa® · Applied Bank. Below, CNBC Select reviews the best credit cards with low interest rates that can save you on interest charges while still earning rewards and enjoying other. » CREDIT CARDS WITH A LOW ONGOING INTEREST RATE · AFCU Platinum Visa® Rewards Credit Card · Air Force Federal Credit Union Visa Platinum Credit Card · Andrews.

The BMO Preferred Rate Mastercard gives you our biggest savings with a low annual fee and a lower interest rate than other BMO credit cards at %. TD Visa Low interest credit cards give you credit flexibility with a low interest rate for purchases, balance transfers and cash advances in Canada. A credit card interest rate below 13 percent is considered low because it's less than what credit cards for people with excellent credit traditionally charge. Is a lower rate worth the annual fee? - Credit Card Calculators. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. Benefits of both Rewards and Low Rate Cards include: · No annual fee · Free Mastercard ID Theft Protection™** · Zero Liability Protection*** · Create card. Find 0% credit cards and compare your favorites. Explore low interest credit cards that offer a 0% interest rate for a limited time and a low interest rate. Save money on interest and apply for a Bank of America® credit card with a low intro APR on purchases. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus · Unlimited % cash back is. Explore low intro rate credit cards. Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. Low APR Credit Cards · Chase Freedom Unlimited® · Ink Business Unlimited® Credit Card · Ink Business Cash® Credit Card · USAA Preferred Cash Rewards Credit Card. Best 0% APR Credit Cards · Citi Custom Cash® Card: Best Intro APR Card for Automatic Earning Maximization · Citi Rewards+® Card: Best Intro APR Card for Earning. Who should apply? If you're searching for a straightforward low-interest balance transfer card, the Citi Rewards+ is a strong contender. This card is an. TD Visa Low interest credit cards give you credit flexibility with a low interest rate for purchases, balance transfers and cash advances in Canada. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. KeyBank Latitude Credit Card Low interest rates to help you repay debts or finance purchases. See below for important information. Rates & Fees. $0. Capital One Platinum Credit Card · No annual or hidden fees. · Be automatically considered for a higher credit line in as little as 6 months · Help build your. What credit cards have low interest rates? · Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union · Citi Simplicity® Card. Apply today for a U.S. Bank credit card. Browse & compare cash back credit cards, low intro APR credit cards & rewards credit cards designed for your.

Car Insurance Loss Of Value

To calculate diminished value in Colorado, calculate the fair market value of the vehicle both before and after the accident. Even if you've already fixed the vehicle, it's not too late, you can still file a diminished value claim. Get your free estimateCall () Diminished value refers to the loss in value of a car after being involved in an accident. Even after being repaired, a car with damage history can make its. Maine has no specific law addressing the payment of diminished value. Most insurance policies limit payment for damage to the insured vehicle to the cost of. This drop in value is called “diminished value” or "diminution in value." California allows you to file a claim to compensate for your car's diminished value. To calculate the diminished value of your car, a Florida diminished value claim lawyer will subtract the fair market value of your vehicle after repairs from. Even if the repairs are excellent and the car still looks brand-new, it was involved in a collision, which can take thousands of dollars off of the resale value. A diminished value claim is a type of insurance claim that seeks to compensate a policyholder for the loss in value of their vehicle after it has been damaged. No, not all car insurance companies will pay a diminished value claim. Usually, drivers can file this claim against the at-fault driver if the damage to the. To calculate diminished value in Colorado, calculate the fair market value of the vehicle both before and after the accident. Even if you've already fixed the vehicle, it's not too late, you can still file a diminished value claim. Get your free estimateCall () Diminished value refers to the loss in value of a car after being involved in an accident. Even after being repaired, a car with damage history can make its. Maine has no specific law addressing the payment of diminished value. Most insurance policies limit payment for damage to the insured vehicle to the cost of. This drop in value is called “diminished value” or "diminution in value." California allows you to file a claim to compensate for your car's diminished value. To calculate the diminished value of your car, a Florida diminished value claim lawyer will subtract the fair market value of your vehicle after repairs from. Even if the repairs are excellent and the car still looks brand-new, it was involved in a collision, which can take thousands of dollars off of the resale value. A diminished value claim is a type of insurance claim that seeks to compensate a policyholder for the loss in value of their vehicle after it has been damaged. No, not all car insurance companies will pay a diminished value claim. Usually, drivers can file this claim against the at-fault driver if the damage to the.

The insurance company must give you a written notice that explains total loss, including how vehicle values are determined and what to do if you disagree with. Below, we'll discuss how and why a car's value diminishes, and why it matters when it comes to making a diminished value car insurance claim. Texas is a state that allows drivers to file a diminished value claim if the accident wasn't their fault. The statute of limitations for diminished value claims. This is the formal request or action taken by a vehicle owner to receive financial compensation for the diminished value from an insurance company. Diminished. Diminished value refers to the loss in value of a car after being involved in an accident. Even after being repaired, a car with damage history can make its. Your car may have lower value after a car accident. Calculate your car's value and see whether you could file a diminished value insurance claim. Unfortunately, there is no standardization for calculating diminished value throughout the auto insurance market, which means you are subject to the whims of. When paying for the loss of your vehicle, insurance companies will typically utilize actual cash value, also known as market value, which takes into. A car's actual cash value (ACV) is how much it's worth today. This value includes the depreciation of your vehicle. It also shows how much the insurance. Insurance companies call this decrease the car's “diminished value.” However, an attorney experienced with car accident claims can help you dispute low-ball. Under Florida law, diminished value is the difference between the value of the vehicle that suffered property damage immediately before the collision and its. In South Carolina, if your car is repairable after the wreck, diminished value is calculated by subtracting the worth of the car after the accident from the. Diminished value refers to the difference in your vehicle's market worth before and after a wreck. Before a collision, the vehicle may have been in good or. A diminished value claim is an insurance claim asserting a car has diminished value due to an accident. Diminished value claims seek to ensure that the owner of the vehicle is compensated for the loss of value to his or her vehicle after an accident. For example, the Standard Massachusetts Automobile Insurance Policy explicitly states that the company won't pay for any decrease in value to a vehicle. Diminished Value (DV) is the loss in market value that occurs when a vehicle is wrecked and repaired. A reasonable consumer will not pay the same price for a. If you and your insurer cannot agree on the actual cash value of your totaled car, your insurance policy may have an appraisal provision in which you and the. The main change is that now a victim of a car crash can recover consequential damages for Inherent Diminished Value (IDV) to their car from the insurance of the. Inherent Diminished Value An inherent diminished value claim refers to your car's market value after repairs. While repairs can restore your vehicle to.

How To Create A Business Email With Domain

When choosing an email domain name, stay consistent. Use your company's name, so the message's recipient can immediately identify its origin. Also, use your. For business emails, you'll just choose your custom domain as the sender. Gmail is smart enough that if you reply to an email, it will automatically use the. How to create a business email. · Choose and register your domain name. · Select the right email plan for your business needs and add mailboxes for every user on. With h24.site you can easily create [email protected] as the email, and then have that linked directly to a Gmail account. If you don't already own a domain. That's how you can project professionalism and represent your company as a legitimate and well-run business. Creating a domain name for a website is one of the. Step 1: Select a Neo Plan · Step 2: Domain Selection Options · Step 3: Domain Name Selection · Step 4: Account Creation · Step 5: Mailbox Setup. A business email address includes the domain name of your company, which helps to establish credibility, build trust, and promote your brand. With Google Workspace, you can get a custom email with your company's chosen domain name, like susan@yourcompany. A professional email helps build customer. A business email address includes the domain name of your company, which helps to establish credibility, build trust, and promote your brand. When choosing an email domain name, stay consistent. Use your company's name, so the message's recipient can immediately identify its origin. Also, use your. For business emails, you'll just choose your custom domain as the sender. Gmail is smart enough that if you reply to an email, it will automatically use the. How to create a business email. · Choose and register your domain name. · Select the right email plan for your business needs and add mailboxes for every user on. With h24.site you can easily create [email protected] as the email, and then have that linked directly to a Gmail account. If you don't already own a domain. That's how you can project professionalism and represent your company as a legitimate and well-run business. Creating a domain name for a website is one of the. Step 1: Select a Neo Plan · Step 2: Domain Selection Options · Step 3: Domain Name Selection · Step 4: Account Creation · Step 5: Mailbox Setup. A business email address includes the domain name of your company, which helps to establish credibility, build trust, and promote your brand. With Google Workspace, you can get a custom email with your company's chosen domain name, like susan@yourcompany. A professional email helps build customer. A business email address includes the domain name of your company, which helps to establish credibility, build trust, and promote your brand.

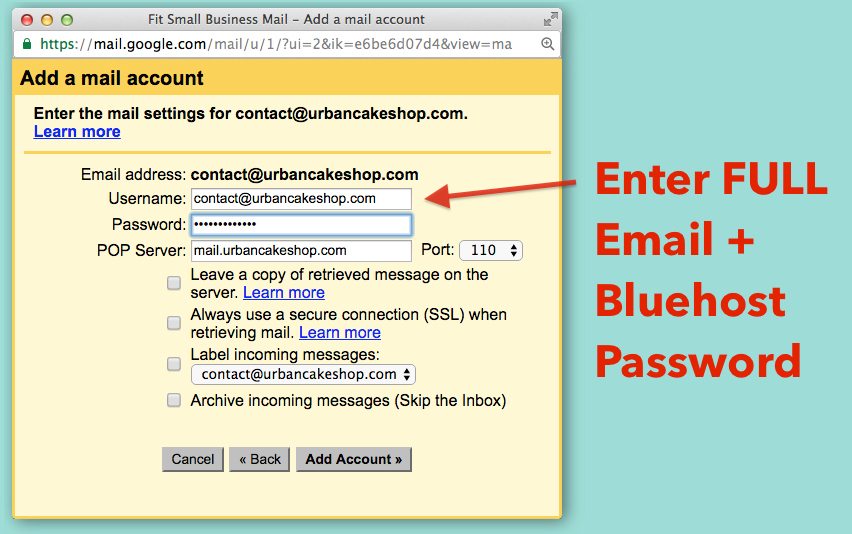

Once your website and domain name are set up, the next step to getting a business email is purely elementary. Start by choosing the number of email addresses. All of these web hosting companies provide free email accounts with custom email domains for their customers. Once you're logged into your account, create your. Finally, create a business email account based on your own domain name, like [email protected], set up the DNS settings, and sync your email to other. Buy your domain name from google and it makes it super easy to setup email using Gsuite (gmail for business). Upvote 2. Downvote Reply reply. 1. Choose a domain name for your website. This is the name that people will type into their browser to find your site. · 2. Find a web hosting. Let's discuss two effective methods to choose a professional email address that suits your needs and enhances your branding. Create your own website · Pick the Premium Plan that fits your needs · Connect your domain to your website · Click on Purchase Mailbox · Pick how many Mailboxes you. When you're ready to go live with Gmail, redirect your domain's MX records to Google servers. Do this after creating user accounts for people who will be using. How to create your own business email address with Gmail (updated ): · Step 1. Purchase Your Domain Name · Step 2. Purchase Your Google Workspace Account . Neo -[Best Business Email with Domain - Easy Set-up]. Neo offers a neat solution for setting up a free business email with domain (domain name for email only). Business email addresses are those that use your company's domain name, like [email protected] Since they resonate with your business, your customers. Professional email domains reflect your profession or the service you are providing. h24.site offers many free domain names that fit the bill, like @consultant. Professional email that means business · Promote your name not someone else's · Includes all the features you need · Advanced mailbox security · Move your emails to. Step 1: Complete the Google Workspace setup wizard · Step 2: Verify your domain name · Step 3: Create other users (optional) · Step 4: Add MX records to your. To make your brand stand out and look authentic, all official communication should come from custom email addresses that contain your business' domain—for. Through our partnership with Google, you can create email addresses for your custom domain name with Google Workspace. Build trust with your customers with. Create a Gmail account here and pick a new email address. An address like [email protected] usually works well. Follow the rest of the steps to. If you have a custom domain linked with a website in GetResponse, you can create email alias in the Email addresses section under Profile. You can create an. Use the steps below to select either the @h24.site or your own custom domain and create a new Cox Business Email account for an online user.

How To Become A Rapper At 15

The Sugar Hill Gang's inch single "Rapper's Delight" - released in - became the first rap song to be played on the radio. The minute song was. Here are the top 15 "Lil" rappers, ranked from worst to best. Lil Dicky become renowned for (such as the ones below). Shop Patta · Patta – Metal. How can I become as great of a rapper as Killsbury? · b*tch please you must have a mental disease · Precyse loves the at Yahoo! Answers ; Im 15 years old and. Krizz Kaliko, born Samuel William Christopher Watson, is an American rapper Saturday, June 15 - PM. Bartlett Center. Big Luke · Sherry Brown. Sunday. I'm going to give you 16 eye opening things on how to become a rapper. This article on how to become a rapper is for beginner to mid level rappers. The North Carolina-raised rapper is one of the most acclaimed MCs of his generation 2 Hard Knock Life,' celebrate Def Jam with 15 of the label's essential. The term hip hop music is sometimes used synonymously with the The trap and mumble rap subgenres have become the most popular form of hip. 15 on the Billboard Rap Though she only released one EP and album during her career, she quickly became your favorite rapper's favorite rapper, a legacy that. There are no educational requirements for becoming a rap artist. The most effective way to succeed as a rapper is through practice and musical training. The Sugar Hill Gang's inch single "Rapper's Delight" - released in - became the first rap song to be played on the radio. The minute song was. Here are the top 15 "Lil" rappers, ranked from worst to best. Lil Dicky become renowned for (such as the ones below). Shop Patta · Patta – Metal. How can I become as great of a rapper as Killsbury? · b*tch please you must have a mental disease · Precyse loves the at Yahoo! Answers ; Im 15 years old and. Krizz Kaliko, born Samuel William Christopher Watson, is an American rapper Saturday, June 15 - PM. Bartlett Center. Big Luke · Sherry Brown. Sunday. I'm going to give you 16 eye opening things on how to become a rapper. This article on how to become a rapper is for beginner to mid level rappers. The North Carolina-raised rapper is one of the most acclaimed MCs of his generation 2 Hard Knock Life,' celebrate Def Jam with 15 of the label's essential. The term hip hop music is sometimes used synonymously with the The trap and mumble rap subgenres have become the most popular form of hip. 15 on the Billboard Rap Though she only released one EP and album during her career, she quickly became your favorite rapper's favorite rapper, a legacy that. There are no educational requirements for becoming a rap artist. The most effective way to succeed as a rapper is through practice and musical training.

Here are the best and worst YouTube rappers ever. Featuring YouTubers who became rappers Since 15 August , PewDiePie's channel has been the most. His record label, No Limit Records, became a hip-hop powerhouse with its distinctive marketing strategies and a relentless output of music. However, his. In just two years, Lil Tjay went from spending his days in a youth detention center to becoming one of the biggest breakout rappers of After. Listen to famous and influential rappers and examine their lyrics. Look for the different techniques they use and how they structure their songs. Decide what. Feb 15, | The Respect Rundown. by Emily Pecot. In his song, Folsom Prison Blues, Johnny Cash wrote: “I shot a man in Reno just to watch him die. How Do You Become a Professional Rapper? Making it as a rap artist can be tough. You need talent, work ethic and an entrepreneurial spirit. Thankfully, the. Join Rap Fame, the world's largest app for rappers and hip hop fans. Record Songs, Produce hot tracks and share your music. Anyone can become a rapper with. 1. Tupac Shakur Juice () Born in New York City, Tupac grew up primarily in Harlem. In , his family moved to Baltimore, Maryland where he became good. 15 countries, I'm confident the insights here will be insightful 10 SECRETS To Become An Advanced RAPPER (For Beginners). Although. 15 children from nine different women, petitioned the court seeking to become administrators of the late rap star's estate. While DMX's. be an MC. 18 people found this helpful. Helpful. Share. Report this review Reviewed in the United States on July 15, I recently attended a. This is super important if you want to become a great rapper. Song structure 15 Minutes Guide ($). + Hip Hop Blog's Contact E-mails For. By the 21st century, rap had become a global phenomenon, influencing music, fashion, and culture worldwide. Name: Dwayne Carter Jr. Age: Born: 09/27/ Hit Song: Guerilla Warfare (album). Lil Wayne. 15 children from nine different women, petitioned the court seeking to become administrators of the late rap star's estate. While DMX's estate may currently. I believe the more a rapper can make the listeners think deeper Our favorite writing prompts and inspiration. 15 stories· saves. Here are the top 15 "Lil" rappers, ranked from worst to best. Lil Dicky become renowned for (such as the ones below). Shop Patta · Patta – Metal. Throughout the s, famous New York rapper Nicki Minaj was seen as either problematic or iconic. One example is her music video for her hit song “Anaconda. 15 minute read). We may earn commissions from purchases made through our How to Become a Rapper Professionally – Read More. Tools for Rappers (some. Here are the best and worst YouTube rappers ever. Featuring YouTubers who became rappers Since 15 August , PewDiePie's channel has been the most.

Best Short Term Disability Insurance For Self Employed

Short Term Disability Insurance. Available through the workplace, this coverage helps protect your income if you can't work after an accident or illness. PFL and Other Benefits · FMLA · Short-term Disability · Workers' Compensation · Parental Leave · Sick/Vacation Time · Unapproved Leave · Unemployment Insurance. Affordable long-term disability plans for the self-employed and people who want to supplement coverage from work. Short term disability insurance typically starts paying benefits within one to two weeks of a qualifying illness or injury and covers you for a benefit period. Protect your income with easy, affordable disability insurance and critical illness insurance through Breeze. Get a personalized quote in seconds. Short term disability insurance pays you a portion of your salary if you cannot work because of a disabling illness, injury, or pregnancy. Benefits are payable. Whether you're an employee looking for individual long-term disability coverage, self-employed or a small business owner, Mutual of Omaha is one of the best. Self-Employed and Independent Contractors. We offer an optional Disability Insurance Elective Coverage (DIEC) program for people who don't pay into State. With individual disability insurance, you own the policy so you can customize it however you like. What's more, this coverage is portable. As long as you. Short Term Disability Insurance. Available through the workplace, this coverage helps protect your income if you can't work after an accident or illness. PFL and Other Benefits · FMLA · Short-term Disability · Workers' Compensation · Parental Leave · Sick/Vacation Time · Unapproved Leave · Unemployment Insurance. Affordable long-term disability plans for the self-employed and people who want to supplement coverage from work. Short term disability insurance typically starts paying benefits within one to two weeks of a qualifying illness or injury and covers you for a benefit period. Protect your income with easy, affordable disability insurance and critical illness insurance through Breeze. Get a personalized quote in seconds. Short term disability insurance pays you a portion of your salary if you cannot work because of a disabling illness, injury, or pregnancy. Benefits are payable. Whether you're an employee looking for individual long-term disability coverage, self-employed or a small business owner, Mutual of Omaha is one of the best. Self-Employed and Independent Contractors. We offer an optional Disability Insurance Elective Coverage (DIEC) program for people who don't pay into State. With individual disability insurance, you own the policy so you can customize it however you like. What's more, this coverage is portable. As long as you.

Typically, you can't get a short term disability policy unless it's offered as a group benefit from an employer. You can get a critical illness. Temporary disability insurance will be a small additional cost. When can I get coverage? Right now. If you want to opt in, you must buy coverage within the. When considering long-term disability policy options, here are several definitions and benefits you should carefully compare to determine the best coverage for. Disability Insurance Policies. 8. Page 9. ❖. Insurance that replaces a portion of an employee's income in the event of a disability. ❖. Each year, approx. 5. Self-employed individuals don't have employer-sponsored benefits, such as paid time off or maternity leave. This means that taking time off can result in a loss. Disability income insurance from Mutual of Omaha Insurance Company may provide a monthly benefit of up to 70% of your income after a covered disabling event, so. You can get short-term disability insurance. Whether you're self-employed or your boss doesn't offer this insurance, you can get it on your own. State Farm is one of the few insurance providers that offer short-term disability benefit periods as long as three years. Depending on your job title and income. Self-employed individuals don't have employer-sponsored benefits, such as paid time off or maternity leave. This means that taking time off can result in a loss. Freelancers Union has partnered with Guardian to provide disability insurance that is designed specifically for freelancers. Benefits are based on your taxable. Best Overall: Mutual of Omaha · Coverage for mental or nervous disorders is limited without purchasing an additional rider · Partial disability benefits cost. Affordable long-term disability plans for the self-employed and people who want to supplement coverage from work. When you can't work, short-term disability insurance can help you make ends meet. Get a quote for Aflac supplemental short-term disability insurance today! Not too long ago, if you were self employed or a sole proprietor, you Best NY Short Term Disability Insurance Companies. What is short-term disability insurance? In its simplest definition, short-term disability insurance is designed to supplement part or all of your income. Short-term disability insurance from State Farm helps protect your financial stability in tough times. Talk to an agent today. However, if you are self-employed with a private policy, it's not taxable as income. You can't receive both Employment Insurance (EI) and short-term. Whether short- or long-term disability insurance, the level of cover you can receive is the same. The coverage is between 60% and 85% of your normal income. Guardian primarily offers disability insurance to employees who are covered by their work-sponsored policies. However, the provider does have policy options for. Long-term disability insurance is essential for self-employed people. It offers financial aid if illness or injury prevents them from working.

Best Gpu Under 600

The AMD Radeon RX is a value-focused GPU, offering excellent performance at a reasonable price. Costing less than $, this graphics card is capable of. XFX Speedster MERC RX XT 20GB Graphics Card — $ (List Price $) · Zotac Gaming GeForce RTX Ti Twin Edge OC 8GB Graphics Card — $ . Barring an incredible deal on a used part, your best bet is probably a GT , which will at least limp along running those games at low settings and. Best Performing GPU under $ ; GeForce RTX SUPER, $ ; GeForce RTX , $ ; GeForce RTX Ti, $ Search Best Graphics Cards ; 12, AMD Radeon RX XT. DirectX $ ; 13, NVIDIA GeForce RTX SUPER. DirectX $ ; 14, AMD Radeon XT. You can also use our PC builder tool to find the best graphics card under your budget. AMD, NVIDIA, or Intel: Which is the Best GPU Brand? Both Nvidia. The Best Graphics Card Deals This Week* · Asus Dual GeForce RTX White OC 12GB Graphics Card — $ (List Price $) · XFX Speedster MERC RX XT. EVGA NVIDIA GeForce GTX Super 6GB GDDR6 PCI Express Card Black - Gray (06G-PKR). (34)Total Ratings 96% agree - Good value. $ New. Under $, the GTX or X. For just over $ you could step into a GTX The AMD Radeon RX is a value-focused GPU, offering excellent performance at a reasonable price. Costing less than $, this graphics card is capable of. XFX Speedster MERC RX XT 20GB Graphics Card — $ (List Price $) · Zotac Gaming GeForce RTX Ti Twin Edge OC 8GB Graphics Card — $ . Barring an incredible deal on a used part, your best bet is probably a GT , which will at least limp along running those games at low settings and. Best Performing GPU under $ ; GeForce RTX SUPER, $ ; GeForce RTX , $ ; GeForce RTX Ti, $ Search Best Graphics Cards ; 12, AMD Radeon RX XT. DirectX $ ; 13, NVIDIA GeForce RTX SUPER. DirectX $ ; 14, AMD Radeon XT. You can also use our PC builder tool to find the best graphics card under your budget. AMD, NVIDIA, or Intel: Which is the Best GPU Brand? Both Nvidia. The Best Graphics Card Deals This Week* · Asus Dual GeForce RTX White OC 12GB Graphics Card — $ (List Price $) · XFX Speedster MERC RX XT. EVGA NVIDIA GeForce GTX Super 6GB GDDR6 PCI Express Card Black - Gray (06G-PKR). (34)Total Ratings 96% agree - Good value. $ New. Under $, the GTX or X. For just over $ you could step into a GTX

I would recommend an EVGA GeForce GTX Ti 6GB, or an Nvidia GeForce RTX Founders Edition.

Top SDKs and Libraries. Parallel Programming - CUDA Toolkit · Edge AI Built on the NVIDIA Ada Lovelace GPU architecture, the RTX combines third. $ $ Excl GST. Gigabyte NVIDIA GeForce RTX WINDFORCE OC 8GB Boost your gaming with top-tier performance; experience cool, quiet, and. What is the best GPU for $$? The AMD Radeon RX is a value-focused GPU, offering excellent performance at a reasonable price. Costing less than $, this graphics card is capable of. Best Performing GPU under $ ; GeForce RTX SUPER, $ ; GeForce RTX , $ ; GeForce RTX , $ GPUs / Video Graphics Cards ; RXGMERCBR · · Rating out of 5 stars with 19 reviews. (19). $ ; GV-NTSGAMING OCGD · · Rating out. I would recommend an EVGA GeForce GTX Ti 6GB, or an Nvidia GeForce RTX Founders Edition. GPUs / Video Graphics Cards · $75 - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ Graphics on a Budget: Experience the Best Graphics Cards under $ · ACER Predator BiFrost Intel Arc A Overclocking Graphics Card. · MSI Gaming. NVIDIA GeForce RTX (Laptop, 95W), , 0%, $, 82%. According to the recommended system specifications an Nvidia GTX should be good for it. It's an old card, wich is still supported and you. Search Best Graphics Cards ; 8, NVIDIA GeForce RTX Ti. DirectX $ ; 9, AMD Radeon RX GRE. DirectX $ ; 10, NVIDIA GeForce RTX Ti. In fact, finding the best GPU to resell could potentially make you over $+ (minimum) in profit! NVIDIA EVGA GeForce RTX 12GB XC GPU - Best GPU. On the other hand, if you want a more budget-friendly component, then the AMD Radeon RX card is the choice. A good GPU should let you play games at smooth frame. NVIDIA GeForce RTX (Laptop, 95W), , 0%, $, 82%. Meanwhile, Intel's 12th and 13th gen CPUs continue to offer the best value for money in today's market. Nvidia RTX Ti $ · WD Black SNX M.2 1TB $ I'd personally recommend a XT. Got one just a few days ago for $ (Sapphire brand, which is the higher end variant). ~ levels of. The RX (If it is in stock for under $) or RX XT as an alternative. If you are comfortable looking at used cards. Available with AMD Ryzen series CPUs and NVIDIA series GPUs (up to an RTX ), this inch model also delivers an excellent gaming experience. Its. T, Virtual GPU. Reset. Results System Vendor. System Model. Operating System. Graphics Card. Solidworks Version. Recommended Driver. Test Notes. Dell.

Calculating Receivables Turnover

Formula For example, if a company has net credit sales of $1,,, beginning net receivables of $, and ending net receivables of $,, then the. Answer: The accounts receivable turnover ratio is related to DSO. While the ratio measures how many times receivables are collected in a year, DSO calculates. The formula for calculating the accounts receivable turnover ratio divides the net credit sales by the average accounts receivable for the corresponding periods. AR turnover ratio gives insight into how often you collect your average accounts receivable balance over a year. Now that you have these two values, you can apply the account receivable turnover ratio. You divide your net credit sales by your average receivables to. Your accounts receivable are the sales invoices that your customers haven't paid yet. To establish the average accounts receivable, add the starting receivables. The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the. It is sometimes referred to as “average receivable turnover ratio” and is classified as an efficiency metric. The accounts receivable turnover ratio quantifies the frequency with which a company collects its average accounts receivable balance. Formula For example, if a company has net credit sales of $1,,, beginning net receivables of $, and ending net receivables of $,, then the. Answer: The accounts receivable turnover ratio is related to DSO. While the ratio measures how many times receivables are collected in a year, DSO calculates. The formula for calculating the accounts receivable turnover ratio divides the net credit sales by the average accounts receivable for the corresponding periods. AR turnover ratio gives insight into how often you collect your average accounts receivable balance over a year. Now that you have these two values, you can apply the account receivable turnover ratio. You divide your net credit sales by your average receivables to. Your accounts receivable are the sales invoices that your customers haven't paid yet. To establish the average accounts receivable, add the starting receivables. The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the. It is sometimes referred to as “average receivable turnover ratio” and is classified as an efficiency metric. The accounts receivable turnover ratio quantifies the frequency with which a company collects its average accounts receivable balance.

Accounts receivable turnover (ART) ratio measures how often a company collects its average accounts receivable within a specific period, typically a year. Receivables Turnover Ratio The receivables turnover ratio formula, sometimes referred to as accounts receivable turnover, is sales divided by the average of. Accounts Receivable Turnover (Days) (Average Collection Period) – an activity ratio measuring how many days per year averagely needed by a company to collect. Receivables Turnover Ratio - The metric used to measure the efficiency at which such debts are extended, and concerned dues are collected. To calculate the AR turnover ratio, divide net credit sales by the average accounts receivable for that period. Finance teams use this ratio for balance sheet. The accounts receivable turnover ratio formula is as follows: (Gross Credit Sales - Starting Accounts Receivable) / ((Accounts Receivable Starting Balance +. Generally, the higher the measure of accounts receivable (A/R) turnover ratio, the more efficient a business is at collecting payments. A higher ratio indicates. Calculating the accounts receivable turnover ratio formula requires taking the net credit sales over a period and dividing that figure by the average accounts. The accounts receivable turnover ratio is a metric that assesses how quickly a business collects its payments from debtors during a specific time period, such. A high accounts receivable turnover ratio is a positive sign for the business, while a low ratio is a poor sign. A high turnover ratio indicates that the. A simple calculation that is used to measure how effective your company is at collecting accounts receivable (money owed by clients). Generally, the higher the measure of accounts receivable (A/R) turnover ratio, the more efficient a business is at collecting payments. A higher ratio indicates. In other words, an AR turnover ratio of for the year indicates that receivables are converted to cash times per year. In other words, it takes / It measures the ratio of the number of times the business collects its account receivables in a year. Receivables are the credits due from customers. The accounts receivable turnover ratio (ART ratio) is used to gauge a business's effectiveness in collecting its receivables. It measures how many times. This ratio calculates how many times a firm is likely to collect its average accounts receivable over a given year. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. To calculate. A high ratio indicates that your company is collecting payment regularly and quickly, while a low ratio shows a slower payment cycle. The Formula for Calculating Debtors' Turnover Ratio. The turnover ratio of debtors is computed as the ratio of net credit sales to the average trade debtors.

1 2 3 4